Award-winning PDF software

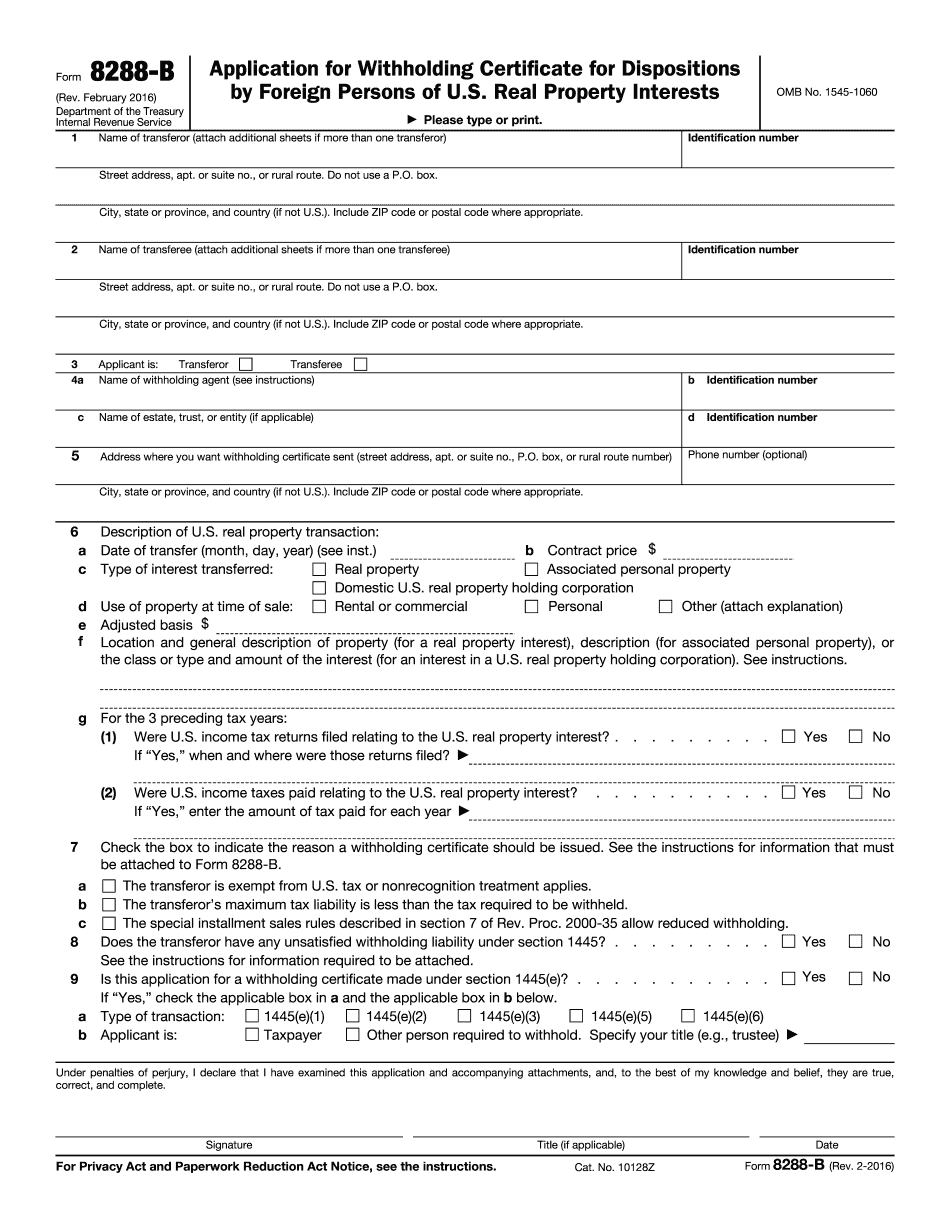

Form 8288-B online Colorado Springs Colorado: What You Should Know

Inventory Certificate Information about Form 4845, Inventory Certificate — Colorado Department of Local Affairs Form 4845 is used for the Colorado Department of Local Affairs to receive inventory tax certificates to be submitted by a taxpayer with inventory of tangible personal property. Form 4845 is also used as an inventory record (which is a certified copy) by the Department of Revenue for the purpose of processing and assessing tax. About Form 764–R, Return on Deeds — Colorado Department of Local Affairs Form 764-R: Return on Deeds May 10, 2025 — For purposes of Colorado tax planning, you need to know the difference between a deed and a rental agreement. This is true. Form 764-R is used when a Colorado resident dies and leaves behind valuable real property. The purpose of Form 764 is to request a rental agreement from the successor of the deceased taxpayer. In other words, it is a form that is used just to prove that the successor owns the property and that the rent may be exempt from capital gains taxes if the successor is taxed at the lower rate. Form 764-R should be completed and returned to the county tax assessor's office for collection. It should include: — The name, address and date of death of the surviving spouse or individual. — The name, address and date of birth of the deceased. — The address and time of death of the successors. About Forms 1-11, Property Tax Bill, or Tax Bill, and Form 1-12, Real Estate Settlement Statement and Assessments, Colorado Department of Local Affairs Information about forms 10-1, 10-2, and 10-3, Property Tax Bill, or Tax Bill, and Forms 1-11, Property Tax Bill, and Form 1-12, Real Estate Settlement Statement and Assessments, Colorado Department of Local Affairs About Tax Return Information for Colorado Taxpayers — Colorado Department of Local Affairs Forms 11, 11A, and 11B–1 require the taxpayer to provide information on capital gains and losses, for taxable sales and exchanges of real property. The form 11A and Form 11B–1 are prepared by the Real Estate Commission. Form 2, Real Estate Settlement Statement, is designed to notify you for the real estate transaction for the year. Also, a Form 2-G is needed to get a final copy of your settlement statement if an objection is made against the sale.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8288-B online Colorado Springs Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8288-B online Colorado Springs Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8288-B online Colorado Springs Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8288-B online Colorado Springs Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.