Award-winning PDF software

Chicago Illinois Form 8288-B: What You Should Know

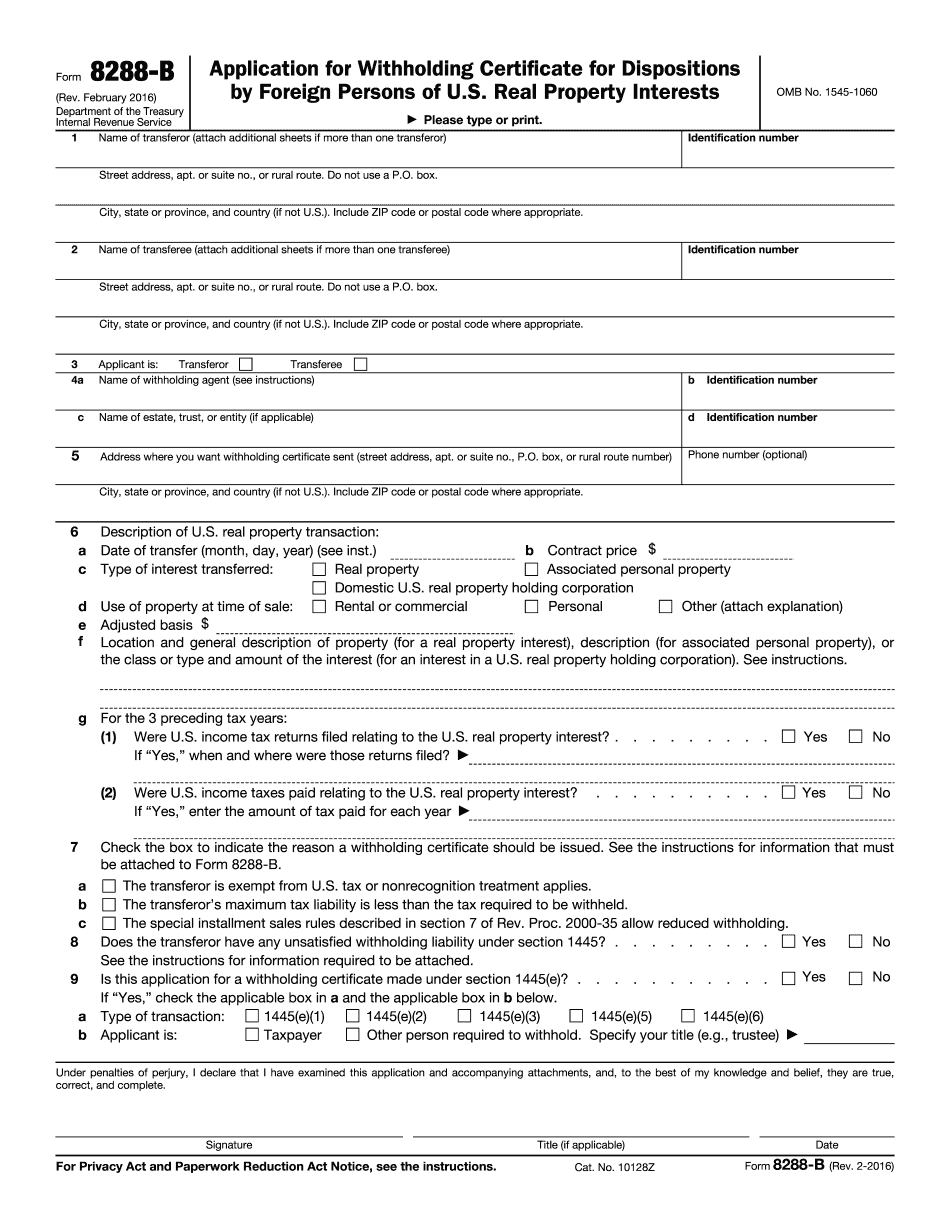

Form 5498 with accompanying Instructions (IRS Form 5498) is the proper IRS Form. In my office we have the current version of the Form 5498 (with the changes made in the February 2016). Form 5498 (IRS Form 5498) This form is to be submitted to the IRS by our customers asking them to withhold an amount from their sale of property. I will need to have the sales contract, the certificate of title, the sales price list and tax bill and the sales contract, certificate of title and sales title will need to be verified by the appraiser, the IRS and the broker. The seller can request that the sales contract be sent to one of my offices for review or have the current sales agreement mailed and mailed by the appraiser and then sent to the IRS. If the sales agreement is emailed to me and then forwarded to the appraiser for review by them, we have a problem. Please include a scan of the document sent to you. Form PTA (Sales Contract Only) This item is to be submitted to the IRS to obtain Form 5498. I will need a copy of the sales contract but also need to know the current valuation of the property. Please also include your sales contract with the document sent to me by the appraiser. I need the current total of the sales price plus sales tax. The IRS does not allow a payment plan. Please make sure that this document is completed and your total sales price is above the appraisal value. Additional Requirements If you would like to use Form 8288-B, and you have a seller who is selling a new home, you will have to obtain a new FIR PTA before you can sell. Please see our Form 910-PTA for more information. Seller's Notice to Seller If you want the amount to be deducted from your sales to be treated as income, please see IRS Notice 2013-45. Form 910-PTA (PTA To Form 910) For Form 910PTA, you will need to enter your sales contract and also provide the sales price of the property you are selling. You can have the sales document forwarded to you, the appraiser, the IRS and/or another person for review, but remember, the IRS considers a sale to be completed when the contract is provided to the appraiser for review.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Chicago Illinois Form 8288-B, keep away from glitches and furnish it inside a timely method:

How to complete a Chicago Illinois Form 8288-B?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Chicago Illinois Form 8288-B aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Chicago Illinois Form 8288-B from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.