Ah, you're here because you want to know about FERPA and how it fits into your real estate transaction. Wikipedia calls FERPA an act to provide revenues reconciliation as provided by section 3 terms of the Congressional Budget Act of 1974. FERPA stands for Foreign Investment in Real Property Tax Act, which is a tax law that helps the United States government recoup money that is lost when a foreign homeowner sells their property. Before 1974, when FERPA was enacted, if a foreign person sold their property and left the country, the United States government didn't recoup any money. Unfortunately, the buyer was always obligated to pay the tax on that home. So, this is important to you if you're working with a person who's purchasing a home from a foreign owner because if the foreign owner doesn't pay the taxes, your buyer is left paying the bill. I thought that this playlist will cover free downloadable worksheets for my YouTube insiders. So, you can download your worksheet, subscribe, and keep watching. In South Florida, where I live, we have an awesome mix of people from all over the world, which also means we have homeowners from around the world. There are so many things about Realtors who deal in diverse neighborhoods that add to their expertise. FERPA is one of them because in a diverse neighborhood, those Realtors know that a foreign seller, when they sell their homes, is required to hold 50% of the taxes to go straight to the IRS. So, the buyer is obligated to pay the taxes in addition to all the other costs of getting into a new property. When foreign homeowners sell their property, they're released from the obligation of paying taxes, but the bill doesn't go away. Infrastructure costs, such as filling potholes, adjusting sidewalks, and...

Award-winning PDF software

Section 1445 non-foreign affidavit Form: What You Should Know

NON-FOREIGN CERTIFICATION. (NATURAL PERSON). Section 1445 of the Internal Revenue Code provides that a transferee (Buyer) of a U.S. real property interest must. NON-FOREIGN AFFIDAVIT. (NATURAL PERSON) Section 1445 of the Internal Revenue Code provides that a transferee (Buyer) of a U.S. real property interest must. NON-FOREIGN AFFIDAVIT. (NATURAL PERSON) Section 1445 of the Internal Revenue Code provides that a transferee (Buyer) of a U.S. real property interest must. SECURITY-RELATED. Section 1445 of the Internal Revenue Code provides that a buyer of a foreign real property interest must withhold tax if the transferor (seller) first affix (affixes to, attaches to, or otherwise imparts to) the title statement to Form 3106, Form 3150, or a similar instrument. Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a foreign real property interest must withhold tax. Section 1445 of the Internal Revenue code provides that a transferee (buyer) of a foreign real property interest must withhold tax. Section 1445 of the Internal Revenue Code provides that a foreign real property interest is a security-related interest in a U.S. real property interest, U.S. real property interest held by a foreign corporation, or a U.S. real property interest on real property located in the United States. SECURITY-RELATED. Section 1445 of the Internal Revenue. Code provides that a buyer of a foreign real property interest must, at the time of selling a U.S. real property interest, give a copy of the purchase price, the transfer price, and the transfer documentation to the seller and retain for 3 years the copy and original of the documents, together with two sets of the original documents. Section 1445 of the Internal Revenue Code provides that the seller must then transmit the copy of the documents to the IRS. Section 1445 of the Internal Revenue Code provides that the seller must give the documents to the IRS, along with the required information, within 3 business days of receiving them from the buyer. Section 1445 of the Internal Revenue Code provides that the seller must then, in order to issue its new U.S.

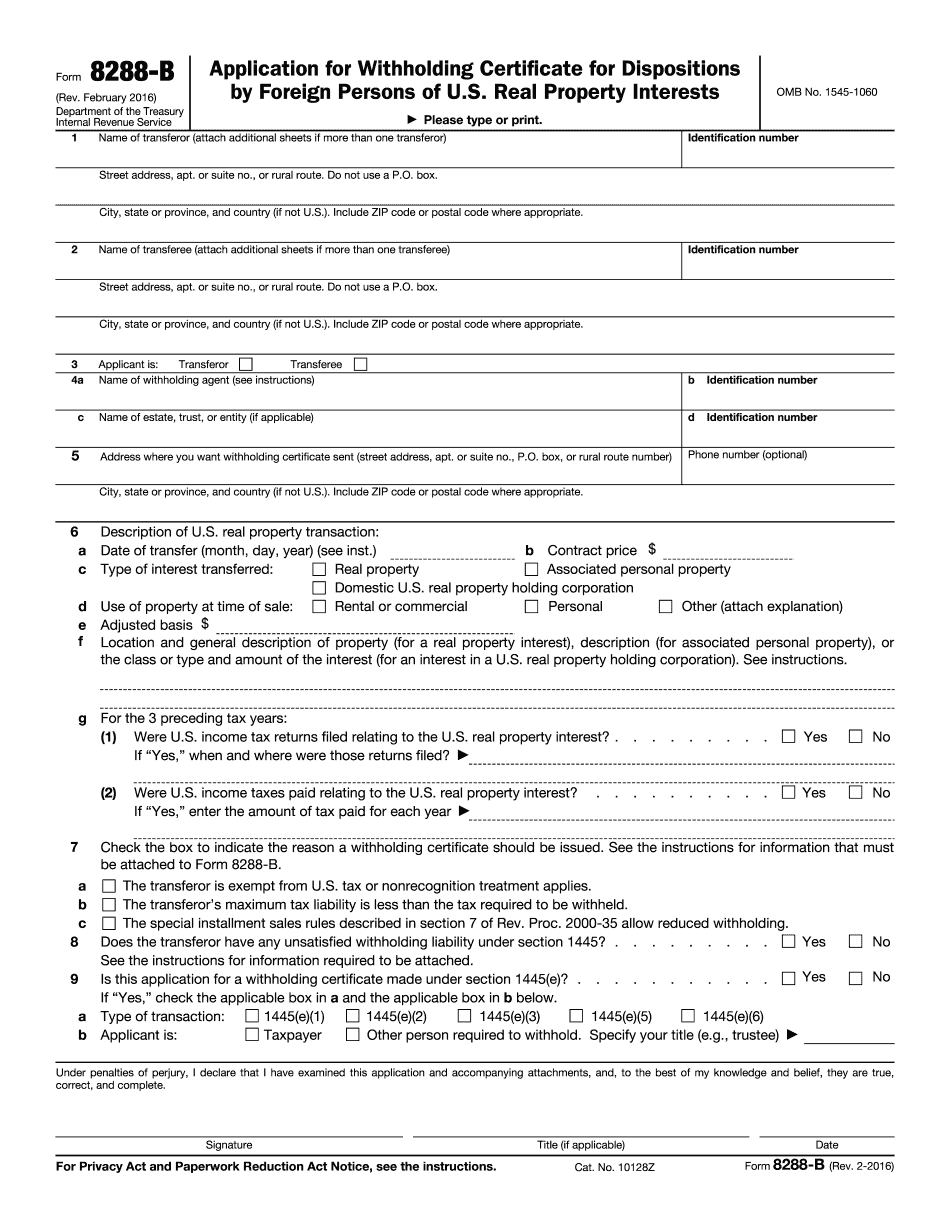

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8288-B, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8288-B online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8288-B by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8288-B from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Section 1445 non-foreign affidavit