Hi, I'm Annie Fitzsimmons. I'm your Washington Realtors Legal Hotline lawyer. Today, we're going to talk about FERPA, the Foreign Investment Real Property Tax Act. We're not actually going to spend a lot of time talking about FERPA itself because I'm not a tax expert and I don't really know very much about FERPA. What I do know about is how you, as real estate brokers, need to address the concern that FERPA has injected into our industry in the last few years. Now, mind you, FERPA has not changed substantially in the last few years, but brokers' treatment of FERPA has changed for the following reason: if we have, as the seller, a non-resident alien as that term is defined by the US tax code, and that person fails to pay taxes required on the sale of the property, then the party liable for payment of those taxes is the buyer. Now, why does the US tax code do that? Because think about it for a second, if we have a non-resident alien, that means that they don't live in the United States and they're not citizens of the United States. So how is the IRS going to get jurisdiction over that person to go after the seller for collections or the taxes? The simple answer is they're not. So who in the transaction can the IRS go after if that seller doesn't pay their taxes? The easy answer is the buyer. That's why FERPA is set up to force the buyer to pay taxes that the seller fails to pay, and it puts the burden on the buyer to confirm the seller's status under the tax code before we get to the closing table. The good news is the statewide forms producer has given you the tools as...

Award-winning PDF software

Firpta affidavit Form: What You Should Know

Do you have questions or need more information? We will be happy to answer any questions you may have about filing your FIR PTA or Form 3473 for Foreign Financial Institutions. Please give us a call at 877.723.

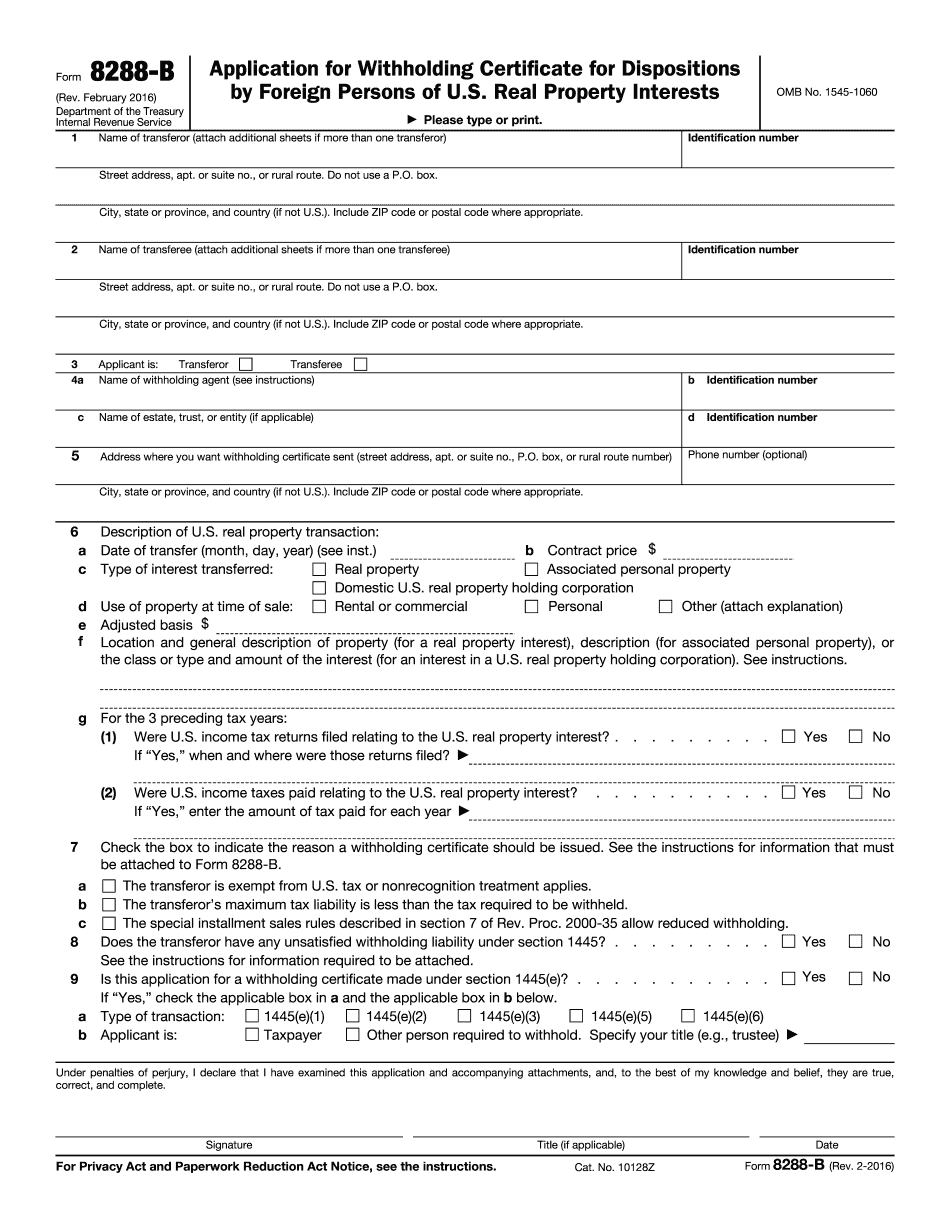

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8288-B, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8288-B online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8288-B by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8288-B from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Firpta affidavit