The next form that will come in the packet with your first check is the Form W-4P. This is your tax withholding form. So, if you notice here, this will not be pretty filled out if you do it ahead of time. But if... If you want to make sure you fill it out a little weird because the signature is up at the top here, so make sure you sign where it says payee signature here. So, if you drop down, you can elect not to have any taxes withheld. Of course, you're going to owe it at the end of the year because this is taxable. And then, or if you want to just simply check which one you are, so are you single, are you married, and how many dependents do you have? And for some of you, you know, some people say, "You know what, I really like getting the tax refund at the end of the year. I really... That's what we go do something nice with it." You can have them withhold extra. Or let's say your spouse is self-employed and every year you get a big tax bill, then you might want to withhold a little bit extra. That's up to you. Once again, seek the advice of a tax professional. I always recommend, you know, when you're working and all you're getting is a W-2, your taxes are pretty easy, so a lot of people do it themselves. But when you retire, especially the first year, if you're going to take out any distributions, if you take Social Security, you're going to be getting 1099s now instead of just W-2s, and you might want to consider hiring a tax professional to look at this and give you some recommendations because I did...

Award-winning PDF software

8288-b early refund Form: What You Should Know

Tax Payments Made from a Deed of Transfer — Form 1040 and Instructions Foreign Fiduciaries and Advisors: the Income of their Property — Fiduciaries Generally Must Report Income on Form 1040-DIV — Fiduciaries Must Register With the IRS on Form 8938 — Income From Securities Generally Must Report on Form 8938 — Foreign Property Trusts and Investment Funds Generally Must Report on Form 8938 — Foreign Property That Is Permanently Located in the U.S. Generally Must Report on Federal Form 8938 (or Form 990) — Foreign Trusts or Entities That May Be Controlled by U.S. Persons generally Must Report on Form 4528 — The Federal Estate Tax, Estate Tax and Tax Planning — If a foreign person lives on his property permanently and is a fiduciary of any U.S. person, then If the foreign person is not a fiduciary, then he must file Form 1040 or Form 1040-EZ or Form 8938. You can find an example of these forms on IRS Instruction Sheet “Forms and Publications Required by Foreign Persons.” See IRS Publication 519, “Fiduciary Duties,” for more information on the requirements for foreign fiduciaries and advisors. To locate the information you need to file for foreign person filers, contact: IRS Forms and Publications If a foreign person lives on his property permanently, then If the foreign person is a non-fiduciary, then he must file Form 1040 or Form 1040-EZ or Form 8938. You can find these forms on IRS Form 3115-A, “Foreign Persons Not in Formation as Fiduciaries.” See IRS Publication 519, “Fiduciary Duties,” for more information on the requirements for non-fiduciaries, see the IRS Publication 522, “Rules for Fiduciaries and Trustees of Foreign Charities,” and Publication 926, “General Information for the Estate and Gift Tax.” Fiduciary Duties — Foreign persons (foreign trusts, estates, foreign trusts and foreign charities) and any domestic trust or estate with a domestic beneficiary (non-U.S. person living on the land) (including a U.S. person living on the land) (includes any U.S.

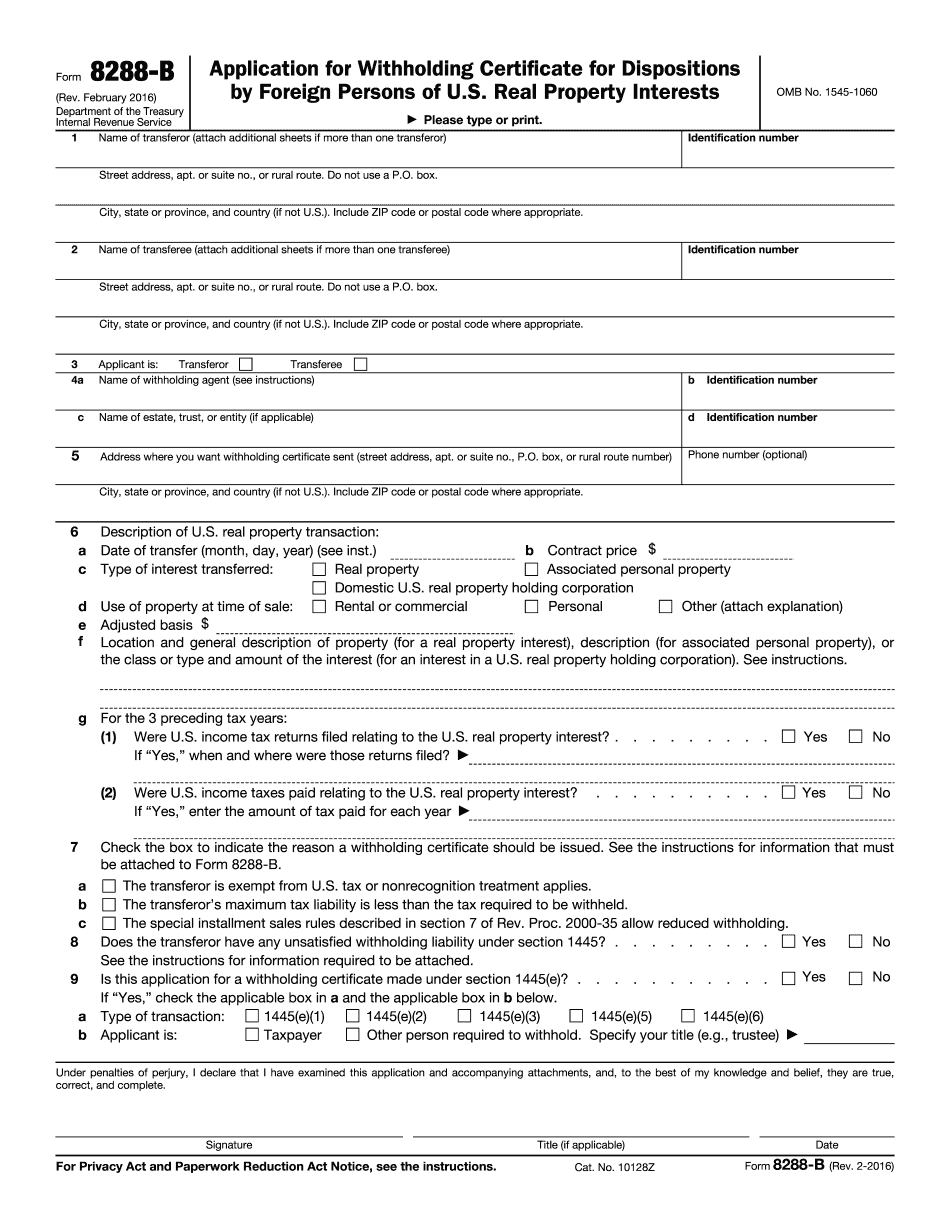

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8288-B, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8288-B online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8288-B by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8288-B from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8288-b early refund