Music, hi, my name is Keith Barrett, founder and president of Vesta settlements. - In this video, we're going to discuss some basics of FERPA - the Foreign Investment in Real Property Tax Act. - Now, before we go too far, let me make a very clear disclaimer first: it can be complicated. - It is based out of the tax code, and I've only read about a hundred of the 15,000 pages that are contained in the tax code. - And nothing that is said in this video is in any way a replacement for professional tax advice from a CPA or a tax attorney. - The purpose of this video is just to go over some real basic stuff and perhaps allow you to red flag some issues in transactions going forward. - So, FERPA. - The purpose of FERPA was there was a concern that foreign individuals were buying properties in the US, selling them presumably at a profit, and then not paying the required tax on that. - This was a problem, and so FERPA was enacted. - FERPA stands for the Foreign Investment in Real Property Tax Act. - It created a withholding requirement in those situations to be sure that the Treasury would get their money. - Here's basically how it works in a real estate transaction in which the seller is a non-resident alien, so not a US citizen or lawful permanent resident (green card holder). - In those situations, there may be a withholding requirement. - Here's how the withholding works: - We start with the general proposition that the withholding is 15 percent of the sales price. - But we have to kind of peel away a couple of layers of the onion here. - If the sales price is over...

Award-winning PDF software

Irs 8288-a 2025 Form: What You Should Know

Foreign Persons with Interests in Real Property in the U.S., 3179 ; Form 8831B, Excise Taxes on Excess Inclusions of Foreign Persons with Interests in Real Property in the U.S., 3187 ; Form 8289, Withholding Tax on Foreign Real Property Interests, 2017. 15 — General Instructions (PDF) For additional instructions and forms, go to General Instructions — General Instructions for Certain Information Returns (SF-IGIR) If you use this or other forms, you will also need the following forms, instructions, and publications. General Instructions SF-IGIR (PDF) For additional general instructions and materials, go to General Instructions—General Instructions for Certain Information Returns (SF-IGIR.) Other Information and Publication Instructions (PDF) For additional materials and instructions that can be found on the IRS Website for general information returns, go to General Instructions—General Instructions for Certain Information Returns—Related Information to the Instructions on Form 8831 For information on U.S. estate and gift taxes, go to How Much Estate or Gift Tax Would a Nonresident Buyer Pay?—In the U.S. and Other Parts of the World. 15.1 — General Information ¶ EIN for Form 8831 The first 3 columns contain the name, address, and Social Security number of the foreign person. The last column contains the tax withholding for the foreign person. For example, if the person is taxed at a rate of 10% and the foreign person's tax liability is 1 million, the first column would contain “10.” Form 8831 also contains the foreign person's name and date of birth, and the foreign person's taxpayer identification number. Use the address and other details from the last column at the bottom to identify the foreign person. To find the foreign person's withholding tax rate on Form 8831, see IRM 21.2.2.5.3, When a U.S. Person Fails to File an Income Tax Return and Returns Withheld by a Foreign Person Using U.S. Form 8831. As with most foreign persons, the foreign person's withholding tax is due at the same time as the foreign person's income tax, so you must determine the amount of withholding tax before you apply it to the income tax. Form 8831 includes all of these information fields: Form 8831, Statement of Withholding on Dispositions by Foreign Persons of U.S.

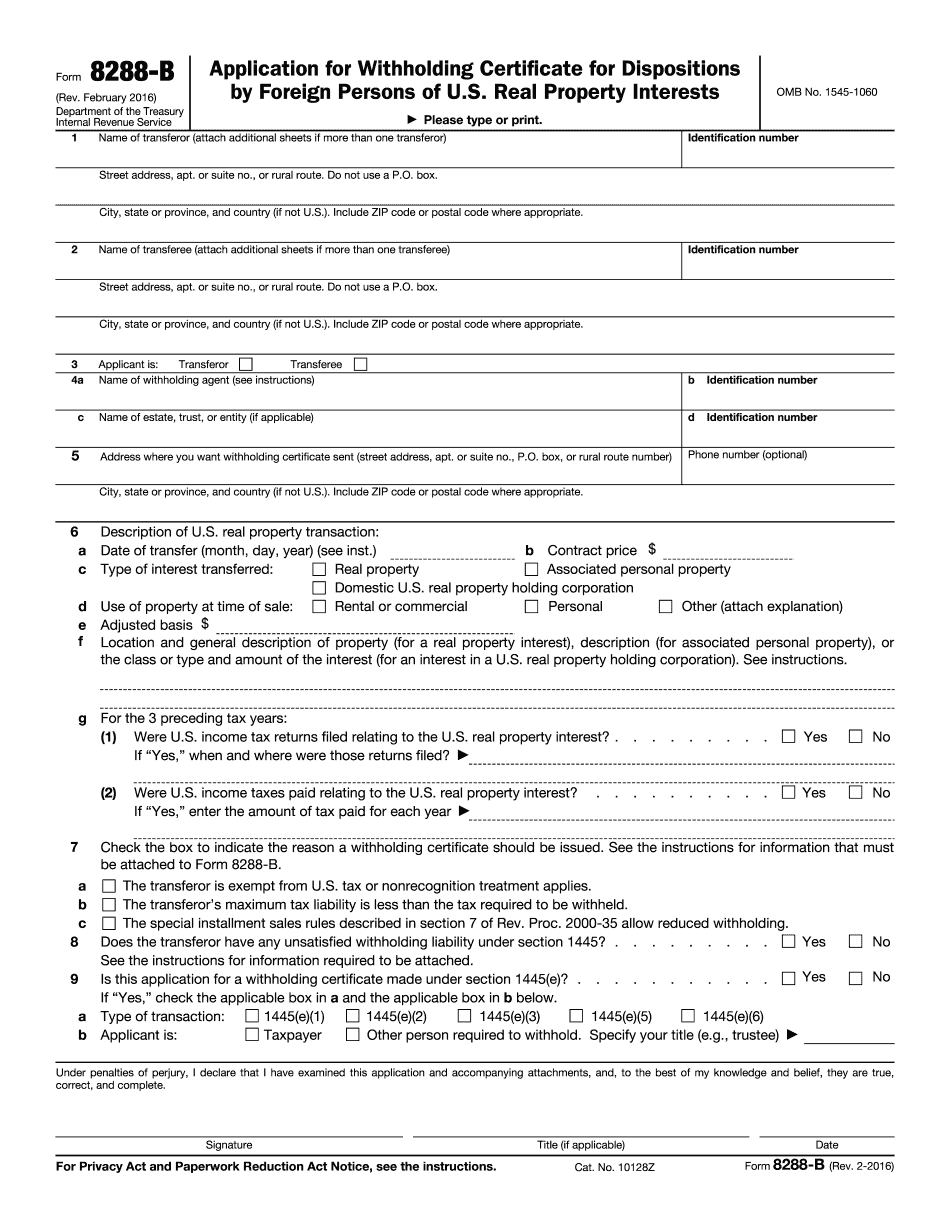

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8288-B, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8288-B online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8288-B by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8288-B from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs form 8288-a 2025